In times of instability and financial turmoil it is only a wise portfolio management that can protect capital from high inflation. Contemporary centralized financial systems have some disadvantages: closed structures and lack of transparency, inferior controls while transferring funds for management, reliance on the team managing capital, and the limited range of strategies used.

Creation of blockchain technology makes the emergence of new markets where blockchain technology can solve problems from centralized systems. However, it also has its own problematic that the price of cryptocurrency and altcoin is too fluctuating, the majority of token holders can not manage the risks skillfully, the number of coins and altcoins that can not be trusted, and the number of cryptocurrency exchanges with limited liquidity.HyperQuant has prepared a solution to overcome this.

WHAT IS HyperQuant

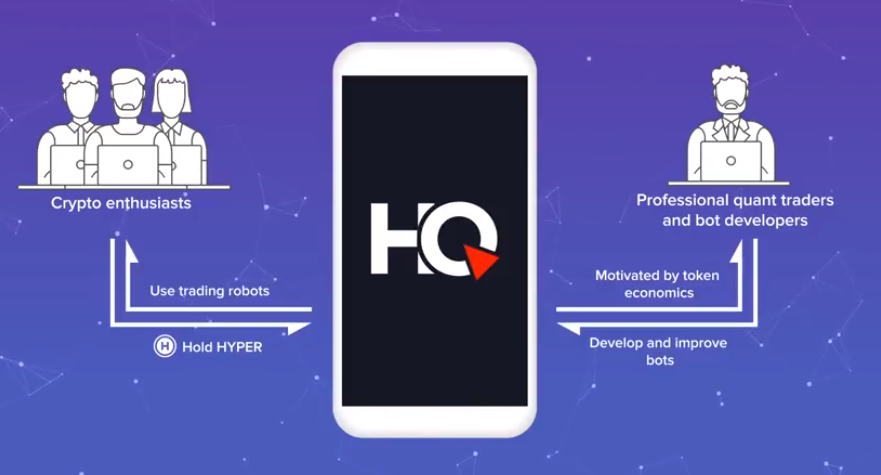

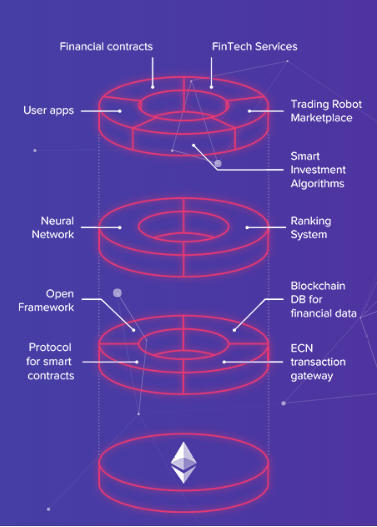

? HyperQuant Blockchain is a platform for automated investment. With HyperQuant the investment process becomes more simple and transparent for all market players ranging from small investors, big investors, to professional capital managers. HyperQuant is a platform dedicated to the creation of highly effective decentralized financial services. The platform provides new opportunities for software developers and algorithmic trading by providing a quantitative framework reinforced by advanced risk management and blockchain AI technologies that ensure system stability and reliability. HyperQuant implements a smart contract realization mechanism. The HyperQuant system provides utilities for the manufacture and development of algorithmic trading solutions. AI regulates ranking and artificial intelligence systems that make it possible to manage various platform elements. The HyperQuant application contains services and solutions for retail and corporate system users.

The HyperQuant ecosystem is not only a much-needed financial tool today, but also a new place devoted to global distribution. AI-based advanced technology is growing rapidly and expanding lately.

HyperQuant's unique feature is the interaction between AI, blockchain technology, and users. This gives users the opportunity to create new products and entities for the platform, such as configuring Megabot, the automated trading system portfolio.The user creates his portfolio containing configuration parameters, identification number bots, and other required system data adding up to the value of the new entity itself into a balanced solution.

HOW TO WORK HyperQuant?

HyperQuant's business model is based on an innovative approach that determines what's important and necessary for users. The concept of this business model relies on identifying high profit zones, determining methods for gaining market share and ensuring its protection from competitors.HyperQuant ecosystem creates an architecture that makes it possible to turn pioneer technology into actual economic value. Services created in the HyperQuant ecosystem have great potential for growth.

HyperQuant uses trading robots to complete trading operations on financial markets with a set of algorithms. Trading with the help of an algorithmic system has several advantages that is to make decisions at maximum speed and to complete trade tasks at speeds that are not available to humans, automatically processing market data and generating trade signals, and

trading signal processing accuracy allows to prevent errors by demand settings market.

Trading robots work strictly in accordance with established algorithms and complete trading operations without emotion and can manage several thousand securities simultaneously.Cryptocurrency traders and token holders are vulnerable to emotions that lead to irrational decisions. Trade strategies apply in any market, with any assets and at any time. Algorithms are carefully typed and have no risk of making the wrong decision because of uncertainty, anger, fear, and dissatisfaction. The basis of the algorithm is in the class division of strategy.

Trading strategies and models have several classifications, as follows:

1. Trend Following Strategy: The main goal of this strategy is to find favorable rates for completing trading operations with the aim of maintaining a profitable position in the longest period of time.Strategies follow the trend of trying to capture the huge fluctuations of financial instruments. A trend-based strategy based on technical indicators is the most popular strategy. Technical indicators are functions based on the values of indicators of statistical exchange, for example, prices of traded instruments. The rules of opening and closing positions in this strategy are shaped by the derivation of indicators and comparative values calculated between themselves as well as the market value.

2. Counter-Trend Strategy: a strategy based on the expectations of significant price movements and consequent positions opening up in the opposite direction. The assumption is that the price will return to its average value. The counter-trend strategy is often attractive for trading because the goal is to buy at the lowest price and sell at the highest price.

3. Pattern Recognition Strategy: The goal of this strategy is to classify objects in different categories. Image recognition tasks in distributing new, recognizable objects to specific classes. Such strategies use neural networks as the basis for education and are widely used for the recognition of candlestick patterns. The candlestick pattern is a particular combination of candlesticks. There are many candlestick models and assumptions about continuous or reverse price movements happening based on the appearance of candlestick models.These assumptions are a strategy based on the introduction of technical analysis.

4. Arbitrage Strategy: There are different types of Arbitrage strategies: Cross-Market Arbitrage and Statistical Arbitrage.

5. Strategy based on machine learning: The basis of machine learning is the modeling of historical data and the use of models to estimate future prices.One type of machine learning is classification.

Based on the above strategy, HyperQuant makes a strategy with Si Technologies Algorithm.HyperQuant's Si Technologies Algorithm Strategy is as follows:

* Smart order execution

strategy This strategy class is based on work with orderbook. The HyperQuant software makes it possible to dynamically cite strategies depending on specific tasks.

It is not possible to execute orders at the same price first, all trades will be at the desired price, but gradually the price will become less profitable. To reduce costs, institutional clients need to use the Smart Order execution strategy. The execution of large market orders can be divided into several steps and involves a combination of strategies.Users of the HyperQuant platform will be able to configure specific fields from quotation strategies such as Instrument, Volume, Minimum volume, Maximum volume, Maximum BBO distance, Internal quotation levels, Internal quotation levels, Hedging, Hedging type and Hedging settings.

* Market Making Algorithms

The execution of market-making algorithms leads to a boost of liquidity in trading instruments. This also results in lower volatility of trading instruments. Providing liquidity is essential for the development of the trading industry. The mechanism of liquidity provision is widespread in the largest stock markets such as NYSE, NASDAQ, and CME. Market makers must support two-way quotes in orderbook and adhere to some requirements The minimum quotation period and the volume of all orders are bought and sold according to market maker data.

* Risk Management

Risk management is the process of adopting and meeting complex actions aimed at reducing the likelihood of unfavorable outcomes and minimizing possible losses. Every trading and investment activity poses certain risks. The risk in this case is the possibility of unexpected financial losses in an uncertain environment. Every trader faces market risk ie the possibility of changes in asset prices due to market exchange rate fluctuations. There are other risks that are rarely known to be operational, functional, selective, and liquidity risks.

* Hedging

Hedging can be divided into Selling Hedge and Buying Hedge. Buying Hedge is used when traders plan to buy assets in the future and seek to reduce risks associated with price increases. Selling Hedge is used in the case of a sale in a commodity market to hedge the risk of future price falls, and implies that the seller fixes a fixed price for himself.

* AI-based Financial Advisers

The majority of investments fail because of incorrect risk management and inadequate control by users. To solve this problem, HyperQuant uses artificial intelligence based on data collected from HyperQuant platform users.

* Blockchain based on Smart Contract Protocol

The HyperQuant team develops an integrated protocol with standard settings for algorithmic strategy portfolios, implemented as smart contracts.

TOKEN HyperQuant

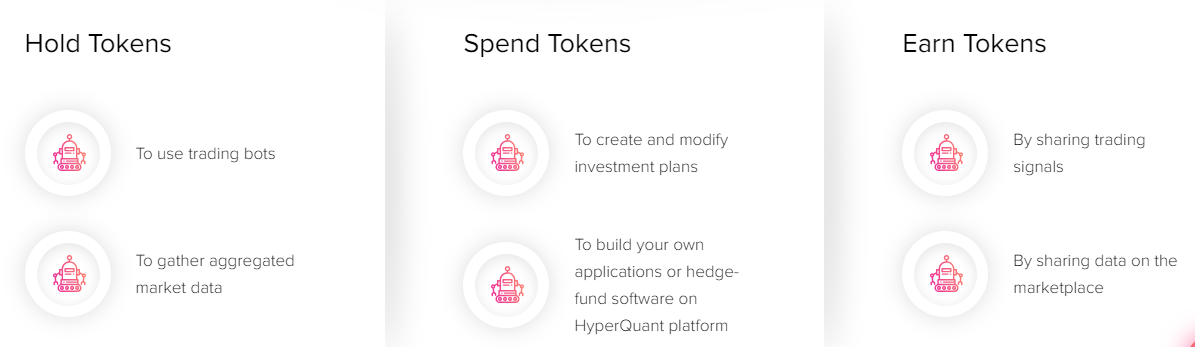

HyperQuant issues a utility token to create an internal economy within the platform ecosystem.By issuing HyperQuant token (HQT), HyperQuant offers all users the opportunity to be the creator of a revolutionary platform, enabling them to manage their capital efficiently. Each HQT Token holder will gain different levels of access to products and solutions based on the HyperQuant platform. The access levels and features available from a particular product will be determined by the number of tokens they have. The economic value of human effort is reflected through the creation of an entity developer on a platform (such as a trading robot).

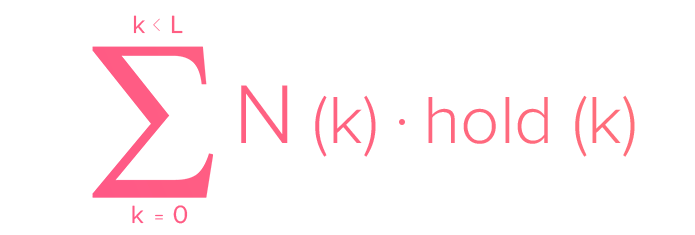

Total number of retained tokens that keep the bots running:

Where:

* L = the maximum bot level

* N (k) = the number of k-level bots on the current platform

* hold (k) = the number of tokens needed to maintain a single k-level bot running

Developers receive the advantage of providing data, and signals to the platform. This approach to incentivize developers will stimulate that they not only create quality entities but also to change and improve them.

Certain steps are being taken to reduce risk when acquiring new platform entities. The user must be fully informed of the entity's properties and potential associated risks. This platform also protects the interests of users by offering a flattened payment system. In other words, it provides full functionality with a limited amount of funds, transforming it into a classical software demo mode.

Such is information about HyperQuant, for more information please visit the link below:

Website | White paper | Telegram | Facebook |Twitter | Medium | ANN Tread

Author :phatpharm20

Bitcointalk Username: phatpharm20

Bitcointalk Profile:https://bitcointalk.org/index.php?action=profile;u=2038562

- ETH Address: 0x1cff5da802703815aea69be79491c636369d0d1f

Comments